Can Store loyalty Programs Save You Money?

This website may earn commissions from purchases made through links in this post.

Store loyalty and rewards programs can be a way to save money – if you use them wisely.

Whether you’re earning points in exchange for gift vouchers, flights, or receiving exclusive offers and discounts, every little bit helps to lower the cost of living.

There’s a catch (well, there are two, really). First, you must be savvy about how you use rewards programs. One of the main purposes of a loyalty program is to encourage you to spend more money. Your goal is to SAVE money. So there are some tricks to ensuring the rewards work for you and do not cost you.

The second catch is all about data.

Disclaimer: This is not a recommendation for any loyalty card, and the general information is not intended to influence your decision. You should seek professional advice and take into account your own personal circumstances before making financial decisions.

So First – Data About Data

Done well, permission marketing benefits both the business and the consumer. I give a shop permission to contact me with relevant discounts and potentially save money when they do.

If a supermarket knows my preferred pasta sauce brand thanks to the information collected via a rewards card and uses that information to send me discounts for said pasta sauce, then the store makes more sales, and I can stock up and save money.

That’s a win-win.

But there’s a hidden cost of ‘free’ loyalty programs. You’re exchanging data about yourself for points. Stores want you to stay loyal to them, yes. They want you to spend more money, yes. But they also want your data because data is big bucks these days.

And increasingly, our data is being sold to third parties and aggregated with other data, and that’s not so cool.

“Some retailers (especially larger rewards programs) also earn significant revenue from trading the data collected from loyalty schemes.”

CHOICE

According to CHOICE, 40% of us are not aware loyalty schemes can sell our data, despite 70% of us being concerned about our data being sold. The ACCC has also ‘reported’ on its concerns (which is a bit limp of them, really). The biggest concern is how this data can be used to discriminate against people.

One recommendation from the ACCC is to read the fine print before signing up for a loyalty program (only 9% of us do, according to CHOICE). We should also consider the value of our data and whether it’s a fair exchange.

If you decide to use a loyalty program (or seven or nine), below are some tips for saving the most money.

Some of the Most Popular Rewards Programs

The two biggest rewards programs in Australia are the Coles Flybuys program and Woolworths’ Everyday Rewards program. But almost every store now has some kind of loyalty program.

Aside from the two biggies, some of the other popular programs include:

- MyerOne

- Qantas Frequent Flyer

- Velocity Frequent Flyer

- Amazon Prime

- My Dan’s

- Priceline Sister Club

- CommBank Rewards

- Cotton on

- Macca Beauty Loop

- Spotlight

- Your local coffee shop.

With about a bazillion more.

There are also cashback sites, which work a little bit differently, but are still a form of ‘reward’ for loyalty.

Cashback sites like Shop Back and Cash Rewards give you a percentage back on online purchases. If you’re going to buy something anyway, then this cashback is money back in your pocket. To get the cashback, you can install a browser extension on a desktop browser, which will alert you whenever a cashback is available.

An alternative to a direct cashback is the Super Rewards program. Similar to the other programs, you get a percentage of online sales with participating stores, but the cash is deposited into your elected superannuation fund.

A final mention goes to the Qantas insurance wellbeing app that links to your Fitbit or other similar devices, and you earn points for the steps you take.

Calculating the ROI of Rewards Programs

First, let’s preface this by saying that no one is going to be doing the following exercise every shopping trip (or any shopping trip) because WHO has time for that!?

However, as a geeky, one-off exercise, let’s look at what points from Flybuys and Everyday Rewards programs are actually earning us.

For both programs, 2000 points get you a $10 gift voucher. That’s the minimum cash-out of your points. So the dollar value of each point is 0.005 cents.

$10 / 2000 points = $0.005

One dollar earns you the equivalent of $0.005. To put it in real terms, for every 210 loaves of home-brand bread you buy, you can earn enough points to get one free loaf of bread.

(This is why your local cafe’s cardboard loyalty card is still the best value if you drink coffee – one free coffee every five to ten, and they’re not even selling your data!)

But what about bonus or ‘boosted’ points, I hear you ask? Don’t they tip the balance in your favour?

Bonus points can get you rewarded faster. But beware, bonus points are a bit like playing Candy Crush: addictive, with intermittent rewards to keep us playing the supermarket’s game.

It’s worth asking how much these bonus points cost us. To work this out, we need to calculate the value of the boosted points compared to the cost of comparative alternatives.

The Cost of Bonus Points

Here’s an example from a recent promotion I received: 80 points earned on a jar of pesto.

I’ve compared the cost with other brands (each 190g, otherwise, we would have to calculate cost per gram as well), the monetary value of the points, and which brand offers the best value even when taking points into account. Prices at my local Woolworths and Coles, July 2022.

| Pesto Brand (all 190g) | Cost | Value of Points @ 0.005c each | Total cost less points value | Savings Compared to Barilla | Winner |

|---|---|---|---|---|---|

| Barilla (boosted to 80 points) | $5.00 | $0.40 | $4.60 | ||

| Sacla | $5.50 | $0.03 | $5.47 | -$0.87 | Barilla |

| Leggo’s | $4.60 | $0.02 | $4.58 | $0.02 | Leggo's |

| Home-brand | $1.95 | $0.01 | $1.94 | $2.66 | Home-brand |

| Sacla (on sale at another store) | $4.40 | $0.02 | $4.38 | $0.22 | Sacla |

I threw the last one in as an example of how a good sale in another store can change what brands are the best value. However, it’s not feasible to comparison shop between stores for every item, every shop.

The best value for money is by far the home-brand jar of pesto. In fact, buying Barilla just for the points will cost you $2.66 compared to buying home brand. Ignoring the pesto on sale at a competing store, the second-best value is Leggo’s for those who don’t like the home brand.

Assuming I bought pesto every week and the cost and points remained constant, I would have spent $260 to earn $20.80 worth of points by the end of the year for a total net cost of $239.20.

By shopping home-brand, I would be $138.32 better off over a year.

To put it another way, at the end of the year, I could have $20 of points to spend on groceries. Or I could have $138.32 extra cash in my bank account to spend on groceries.

If you hate every other brand and never want to switch, it pays to collect the points. But if you’re trying to save money, there are better ways to do it.

This example is just one grocery item. Times that across dozens of grocery items, and you can see why I’m sceptical of end-of-year news stories about people who are ‘saving money’ with all the points they’ve collected.

The question is, will knowing this change spending patterns? Because rewards are a powerful psychological motivator to keep us shopping.

Tips For Getting the Most out of Loyalty Programs

With that said, if you’re already planning to buy something and you’re ok with the whole data thing, then why not get a little bonus now and then?

Below are some tips to make loyalty programs work in your favour.

1. Don’t Spend Money Just to Collect Points

Flybuys and Everday Rewards push bonus points a lot.

But as we’ve seen above, chasing bonus points might cost you money. And if you’re stocking up on things you don’t need and won’t use, you’re throwing money in the bin.

Ask yourself, would I make this purchase if there were no points on offer? Are the points swaying my decisions? Question whether the points make sense for you and really represent value for money.

2. Shop Around for the Best Price, In Spite of Points

Loyalty programs are designed to encourage you not to shop around, i.e. keep you loyal. But by not comparison shopping, you could be over-spending.

It’s not feasible to comparison shop every grocery item between stores. But for larger items, it pays to shop around and save.

Cash in your pocket is always better than potential points, especially if those points expire.

3. Be Wary of Redeeming Points for ‘Stuff’

Some rewards programs allow you to redeem points for homewares, electronics, and other items. But most of these things you can buy much cheaper than you can ‘earn’ through points.

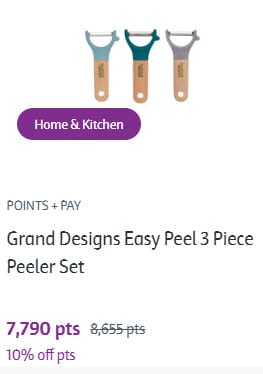

For example, one of the Flybuys rewards (July 2022) is a set of three potato peelers that requires 7,790 points. If you earn one point for every dollar you spend (base rate for Flybuys), you need to spend $7,790 (not including bonus points) to get three potato peelers.

Those three potato peelers are valued at more than a car!

Even with bonus points, they are still the most expensive potato peelers on the planet.

(As an aside, a set of three of these retails for about $40, so that still works out at a point value of $0.005. $40 / 7790 points = $0.005. Not sure why you would need three, but as a comparison, you can get a set of four basic peelers at Woolies for $2.50 or even just one of these fancy ones for $15 without needing to spend nearly $8,000 on groceries first.)

I know. You’re not really buying them; you’re getting them free after buying six months’ worth of groceries (averaging $350 a week). But is it really worth it?

If you’re collecting points on purchases you need and normally buy, getting $10 off your groceries now and then (or saving them up for Christmas) leaves extra cash in your pocket. A win for you.

But spending nearly $8,000 to ‘earn’ a potato peeler seems pretty crazy to me.

4. Use Email Campaigns to Your Advantage

Signing up for a loyalty program means signing up for the store’s email newsletter.

This can be good if you need to buy something or if you get member’s discounts or coupons, say, for your birthday. By planning your purchases around sales, you avoid paying full price, saving you money.

But if receiving emails encourages you to impulse buy stuff you don’t need, you’re better off unsubscribing.

To work around this, you might have an email account specifically for store opt-ins, so you don’t see these emails in your everyday email account, but you can still check them out if you’re looking for something to buy.

Alternatively, you can set up a filter that directs all emails into a folder rather than your inbox. Again, this means you can get the emails without seeing them unless you choose to.

This started as an article on tips for making the most of loyalty programs and ended up as a ‘buyer beware’. Sure, you can try to game the algorithm or use the latest app to chase bonus points, but is it really worth it? Or are we spending A LOT of money for a few measly points that don’t have that much value?

Because at the end of the day, these loyalty programs are really rewarding big spenders. And if you’re trying to save money, spending more is the last thing you want to do. When it comes to saving money with store loyalty programs, it’s important to calculate your return on investment, work out if they are right for you, and view points as a bonus rather than a way to save money.

We are in the Woolies scheme which is great for us as I fly to the UK every year and with the points I get from flying I regularly qualify for free tickets. (The further you fly the better value the points are)

I am also in the Coles Scheme because they give points when I fill up the work vehicle with a company fuel card. Last year I got $40 in vouchers for money that I didn’t personally spend.

That’s great you get free tickets with the program!! Do you have to fly Qantus to get the extra points?? I get $20 vouchers lol.

As well as Woolies we get Frequent flyer points from;

Ffying Quantas, Finnair, British Airways, Cathay Pacific one round trip to UK every year and one single

1 point every dollar spent on a no fee rewards credit card which is paid off every year.

In a typical year we get enough points for a Australia to UK single ticket.

When I was travelling a lot more for work we could save enough points for 2 Australia to USA return tickets a year (But I was spending about 200 hours per year on planes)

Although we buy a lot from Woolies it doesn’t stop us buying from Aldi to get things cheaper, or using a different card if we have to pay extra to use the rewards card.