10 Best Money Management Apps for Australians (2023 Update)

This website may earn commissions from purchases made through links in this post.

Looking for a money management app to help you budget? Here are 10 of the best budget apps for Australians, including new apps available in 2023.

Want a more flexible way to manage your money?

Well, there’s an app for that.

From banking on the go to tracking expenses, the following apps will make managing your money easier.

In this article, I share 10 of the best budgeting apps that can help you manage your money.

What’s more, these budget apps are either specifically designed for Australians or can be used by Australians.

This article has been updated to include the best budgeting apps of 2023. Since first writing this article in 2016, it’s surprising how many apps have entered and dropped out of the market.

ASIC’s Money Smart App ‘Track My Spend’ is no longer available to download and is no longer being updated. This is a shame because it was a great basic budgeting app for manually tracking expenses. People have emailed and asked for Pocketbook alternatives (see below), and I’ve ditched the ATM locator apps because we rarely need an ATM anymore.

The updated article includes new budgeting and savings apps to help you with your money goals. Whether you need a budget, you want to be able to track all your accounts in one place, or you’re looking for alternate ways to split expenses or give kids pocket money, there’s a personal finance app that can help.

After the budgeting apps, I also share some of the best apps that help you SAVE money so you can stay on budget!

Disclaimer: Please note that Frugal and Thriving is not making any recommendations about these apps and has no affiliation with any companies. Please research the apps, read the reviews, and check out the websites, their FAQs, product disclosure notice, terms and conditions, and data protection policy before deciding if any apps are right for you.

10 Best Money Management Apps for Australians

Budget your money, check your balance, get notifications for bills, share expenses with other people, and keep track of tax receipts.

There are apps for all sorts of budgeting needs.

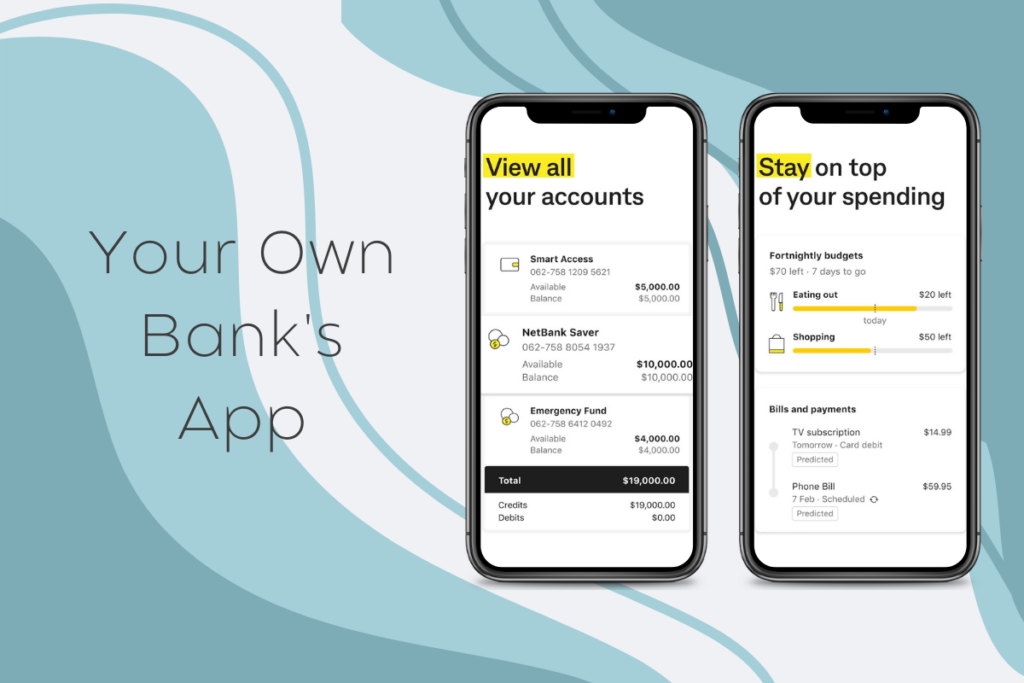

1. YOUR BANK’S APP

If your bank has a mobile banking app, chances are you don’t need a second budgeting app; your bank’s app may have features that help you create a budget and track your spending.

Features

If your bank has this feature, you can use your phone to ‘tap and pay’ instead of carrying around your wallet.

Depending on which bank you are with, you may also be able to:

Cost: Free

Availability: Android and iOS

2. GOODBUDGET

While Goodbudget isn’t Australian, the app can help Australians create a budget, categorise expenses, and track spending.

This app is based on the envelope budgeting method but in a digital format. I use this one to track our variable spending categories like groceries and fun money.

This app requires manual entry of expenses. If you want an app that DOESN’T link to your bank accounts and you’re happy to enter all of your expenses manually, then this is an app to try.

The basic version of the app is free to use with an optional premium upgrade. The app allows you to create up to 20 envelopes in the free version (10 regular and 10 more), track debt, and sync across two devices. For most people, this should be sufficient. If you would like unlimited envelopes, accounts, and up to five devices, the premium version costs $8US a month or $70US a year.

Who might benefit: Those who want to avoid linking their accounts to an app and are happy to do manual budget tracking.

Features

Pros

Cons

Cost: Free with ten regular envelopes, $8US per month for unlimited

Apple Rating: 4.7 (12.8K ratings)

Google Play Rating: 4.4 (19.2K ratings)

Website: Goodbudget

You might also like: 13 Apps That Save You Money

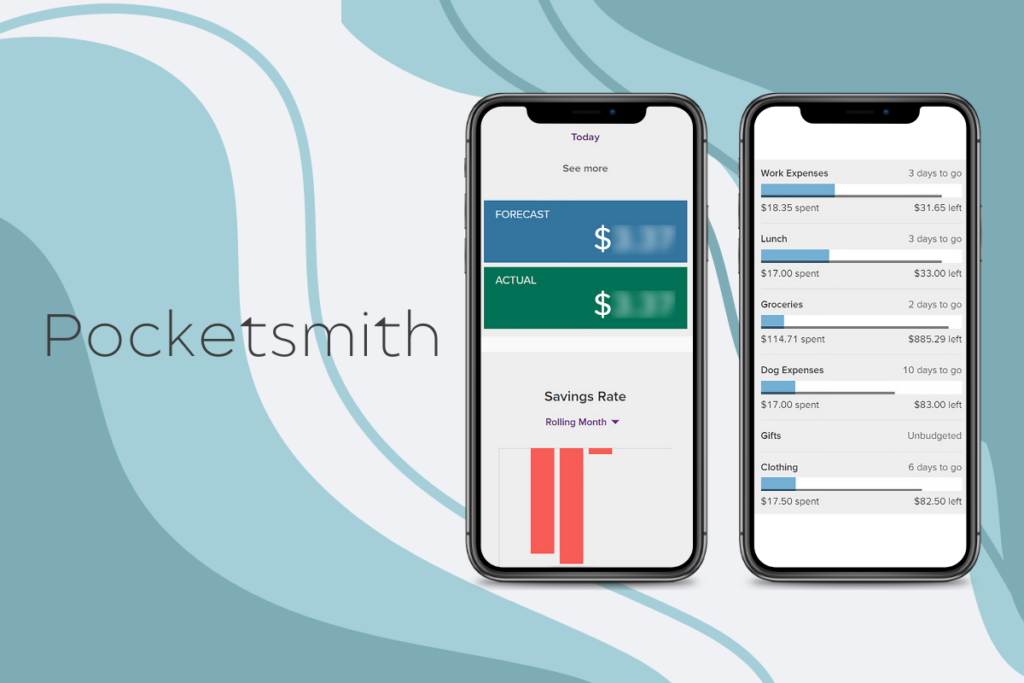

3. POCKETSMITH

Pocketsmith was founded in New Zealand and is the self-proclaimed alternative to Mint. That means you can connect to your bank accounts so all your information is in one place, create budgets, track spending, create savings goals, and see your net worth.

It is primarily a web or browser-based service. The Pocketsmith Sidekick app allows you to view your budgets, balances, and spending, but all the setup is via a browser.

The free plan is manual entry, while the paid plan connects to 163 financial institutions within Australia (you have to share your banking password – see their security page, and how-to page for details).

The manual entry is made easier by importing your transaction history as a CSV file. You will then need to categorise each transaction.

Who might benefit: Those looking for a feature-rich expense-tracking, or a web-based app with the option to connect to your accounts (pro version) OR upload a CSV file and manually enter data. Not great for those who don’t have a computer.

Features

Pros

Cons

Cost: Free with an optional premium ($10.95AU/ month) and premium-plus ($21.95AU/ month) subscription

Apple Rating: 3.3 (51 Ratings)

Google Play Rating: 3.6 (135 Ratings)

Website: Pocketsmith

4. FROLLO

Frollo is an Australian, free budgeting app. It is a full-feature app that automatically connects your bank accounts (with open banking – no password sharing) to track spending, create budgets, and create savings goals.

If you’re like me and wondering how a free app makes money (what’s the catch, right?), according to their website, Frollo makes money by building apps for other companies based on the free app (like the Canstar app below). User feedback on the free app helps them make better products, and they can test new features on the free version.

As a side note, I had to install this app on a tablet as it wasn’t compatible with my four-year-old phone.

Who may benefit: People who are happy to connect their bank accounts to an app and have their budget almost completely automated.

Features

Pros

Cons

Cost: Free

Apple Rating: 4.0 (807 ratings)

Google Play Rating: 3.4 (276 ratings)

Website: Frollo App

5. AUSTRALIAN TAXATION OFFICE

The ATO app helps individuals and sole traders view their tax accounts and super fund. Log in using your MyGov account and view and lodge tax returns.

But the main benefit of the app is recording tax deductions and mileage on the go, so you capture all available deductions. There’s nothing worse than trying to find receipts and remember deductions at tax time.

Who might benefit: Individuals or sole traders wanting to keep on track of tax deductions easily.

Features

Pros

Cons

Looking for ways to make money with your phone? Check out Apps That Pay You Money – Best Money-Making Apps for Australians.

6. SPRIGGY

Spriggy is an Aussie pocket money app that makes cashless pocket money for kids easy. Linked to prepaid Visa cards (not credit), parents can top up their kids’ cards via the app, and children can earn pocket money by completing chores.

I wish I had known about Spriggy a year ago. We were looking for a solution for our son to have a debit card without it being linked to his bank account (in case he lost it or it got stolen – I didn’t want him to lose all his savings if someone took his card). We looked at getting a pre-paid debit card for him, but as he wasn’t 18, he wasn’t eligible.

I have yet to try Spriggy fully, but a friend uses it all the time, and she took me through her account, explaining how she uses it. Apart from a few bugs, she loves the app, although she noted that her youngest child is still too young to really ‘get’ it. It’s probably best for kids around ten years and up.

Who might benefit: Parents looking for a cashless way to manage pocket money and allow kids to spend and save.

Features

Pros

Cons

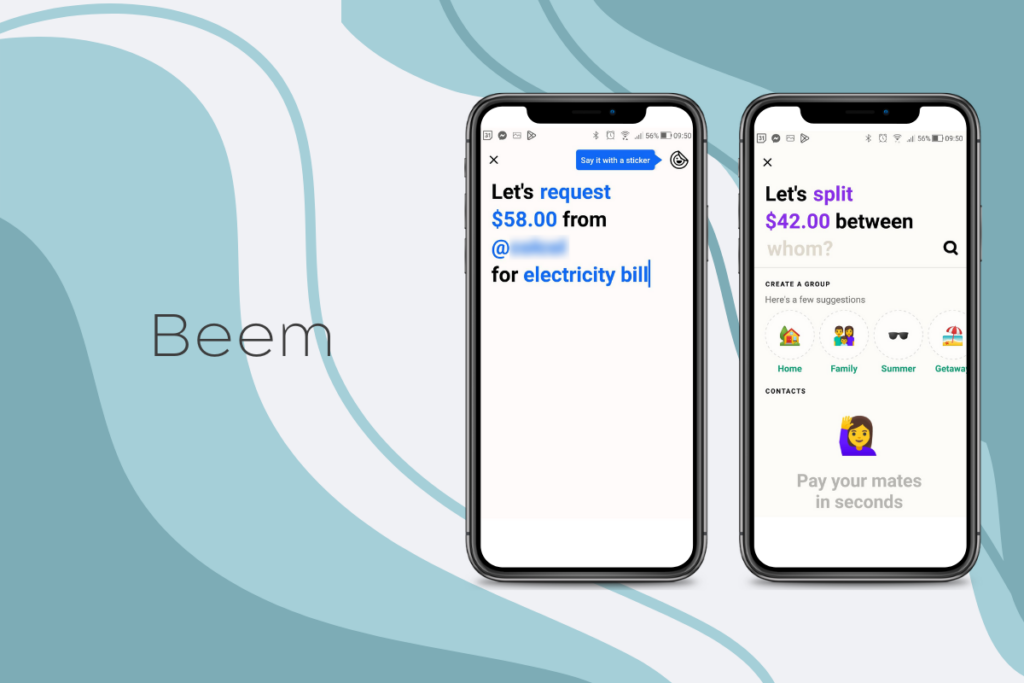

7. BEAM

Beem (formerly Beem It) is a digital wallet connected to an Australian debit card that allows you to make instant payments and money transfers between your own accounts or to other Beem users.

The Beem app can help you split expenses, instantly pay others back, and request money, making sharing expenses in a group easy. Rather than needing the BSB and account number, you can pay someone via Beem if you know their username.

Beem is backed by eftpos, the Australian payment provider, and was created in conjunction with Australian banks. It is free to use and currently makes money [source] via referral fees when a user shops at one of its cashback partners.

My mum went away with friends recently, and she said it took ages to work out who owed what to whom. And then they were juggling cash…an expense-splitting app would have removed all the pain and hassle.

Who might benefit: People in share accommodation who need to split bills or those who go out or travel with friends and want an easy way to split expenses.

Alternate app (not Australian) previously reviewed: Splitwise.

Features

Pros

Cons

8. CANSTAR APP

Canstar has partnered with Frollo (above) to create a money-management app with built-in product comparisons, which is what Canstar is known for.

Like their website, the Canstar app features product comparisons, so you can switch and save on bills and financial products (which is how they make money from the app).

For some reason, the Canstar app wouldn’t let me create an account despite trying multiple times, so I couldn’t road-test all of the budgeting features.

Features

Pros

Cons

Cost: Free

Apple Rating: 4.2 (138 Ratings)

Google Play Rating: 3.9 (76 Ratings)

Website: Canstar App

9. FLUX

Flux is an Australian app that gamifies saving money and improving financial literacy; you can win weekly prizes by using the app.

It targets a young audience, intending to make learning about personal finance fun and interesting.

This isn’t a budgeting app so much as a way to use weekly prizes to encourage building your savings.

Who might benefit: Younger people wanting external motivation to save or learn about personal finance.

Features

Pros

Cons

Cost: Free + pro version $7.99AU/ month or $71.99AU/ year.

Apple Rating: 4.3 (237 Ratings)

Google Play Rating: 3.8 (89 Ratings)

Website: Flux Finance

10. WEMONEY

WeMoney is an app designed for Australians, specifically targeting debt elimination, although it also helps you track bills and expenses as well.

I did not road-test WeMoney for this article because, unlike other money management apps, they ask for your driver’s licence or passport details upon sign-up (in other apps, this is optional and only if you want your credit report) and I didn’t want to hand those details over.

Who might benefit: Those wanting all their account balances under one roof or are looking to pay down debt and increase their credit score.

Features

Pros

Cons

SUMMARY

While many of these apps have different functions and do different things, so we’re not comparing apples with apples, here’s a summary of my opinion (for what it’s worth) on the best money management apps in 2023.

BEEM

Highest-rated Australian app. Also the app with the most ratings.

Goodbudget

Best basic budgeting app (no linking to bank accounts).

Pocketsmith

App with the most money-management features.

Frollo

Best overall budgeting app. Almost as full-featured as Pocketsmith, but mobile-based and 100% free.

To be fair, WeMoney and the Canstar app also have a lot of features, but as I was unable to road-test either (see above), they don’t make the cut of best apps for the year.

Money-saving Apps

While these apps help you manage your budget, saving money comes from taking action. Here are the 13 best apps for saving you money.

#1 Cash Rewards

Cash Rewards is a cashback site that helps you get cashback on online purchases. Get cash rebates on shopping you would be doing anyway.

#2 Shop Fully

Keep up to date with all the catalogue sales in one handy app.

Check out the entire list of best apps for Aussies that save money here: Best Money Saving Apps Australia.

I wouldn’t trust any apps made by the Government, or maybe even banks. I recon they would collect the data and use it for tax information (e.g. cash that isn’t recorded for taxation)

I am surprised by your comment Annon. Tax dodging is immoral and you are sponging of people like myself who declare earnings honestly. Perhaps such apps should be mandatory.

Great list – I have been looking for something like Pocketbook for a while. I also like “Stock Market HD” on iOS (not sure about Android) which tracks the prices and has charts and news for your portfolio. The news for Australian stocks is a bit limited but the charts are an easy way to see trends/opportunities.

Hi Quinn, thanks for the app suggestion. Handy if you’re into shares!

we use home budget. It has a small cost but syncs over multiple devices. by inputting all our expenses as they happen it gives us an up to date picture of where things are at. There’s probably free apps that do the same.

It can be worth paying for something that works well for you! Thanks.

The ATO’s app is specifically not for small businesses tracking expenses.

It says so in it’s own information screens.

You have to allocate the expenses to a category, and the categories listed are only for employees.

Thanks Nick for your comment and clarifying how small businesses can use the app!

This is the quote from the ATO website:

“If you’re an individual taxpayer, small business owner or self-managed super fund trustee, you can access relevant tax and super information and tools in one place.”

Sole traders can access the ATO’s online services through the app.

Have you heard of an app called Boomeringo? If so any advice?

I haven’t tried it, sorry.

Try ynab. It is amazing!

Thanks.

I second this YNAB is an amazing app, and the support community that comes with it is awesome too!

I have been using it for the past 2 years, it has helped me to completely turn my finances around. Changed my life!

Thanks for the recommendation! Great to hear from real user experience.

Just wanted to let you know that you can now sync your Australian Bank transactions to YNAB via the third party application Budget Feeder for YNAB, available at https://www.budgetfeeder.com/

Just try Cubux.net ,it’s amazing

While I would not trust any multinational corporation further than I could throw their most recent brand new shiny building, I am still not quite as cynical as those behind some of these budget assessment comments. Yes, if you are speaking about the NSA then every single worker in the place should be jailed for the criminal behaviour they participate in and promote, but your typical banker, the person himself, is simply greedy and dishonest but not dangerous at all when threatened with ‘justice’, unlike government spies or government leaders here and elsewhere, with complete impunity to do anything to anyone. Corruption is, in essence, not such a bad thing since it is usually selfishness and greed underlying the motivation driving it and even the taxation system fits the typical profile of greed without any real malice toward total social harm furthering its end goals, however, the corporate scenario is quite different in its attempted world control through market manipulation, legislative progression over a hundred and fifty years, and the record of, for example, an excess of 100 million deaths just by the tobacco industry alone. That is only one industry out of many many others who do exactly the same and when you include others who most believe primarily make washing machines or light globes but kill multi-millions with their weapon systems that 100 million more than doubles, and no one would even attempt to ague the point. These corporate monsters destroy entire societies, countries, and cultures, which in my humble guess-work amounts to a much greater harm than the typical greedy or overzealous operative simply trying to get ahead of the game. So, yup, I’m cynical too, but mine leans toward those who can easily destroy the planet and all life on earth through climate inaction or nuclear weapons than just a few dishonest jerks who want to own a boat they could otherwise not obtain honestly.

Ken P.

Hello Ken,

I think your tone is very fair. My supposition is that the criminality pendulum is not as far against corporates, bc the little is a reflection of the big man and vise versa i wd like to believe. (I acknowledge that white collar criminals do not get sufficient corrective time in jail). Really together, we ought to be less tolerant of living too shallow and material-obsessed.

Enjoyed this list but looking for expense tracker for MacBook Pro (desktop or laptop) version. I find apps on the phone too small to deal with.

Yes, fair enough.

Not sure about Apple products. Do they have an app store that you can use for a laptop as well? Windows 10 does. Some of the apps I use on my phone I can put on my laptop and they ‘sync’. I’d be surprised if Apple didn’t do that too.

I’m also on an Macbook Pro and personally use YNAB. As it’s web based, it’ll work on various browsers on your Mac. I also use it on my Android mobile devices (phone and tablet) when I’m out and about or away for a few days and don’t have my laptop with me.

It’s a great program depending on what you’re after.

Hi Melissa – I recently have found out that the ASIC MoneySmart TrackMySpend App has been discontinued and was wondering if you knew of any other Apps that are similar – purely a manual data gathering tool that you are able to categorise spending etc but does not have to be linked to bank accounts feeds.

Thanks for your assistance!

Goodbudget. It is manual. Not linked. I now use that.

Hello Melissa,

Thank you for sharing. I find them helpful.

The TrackMySpend App proved to be a handy resource on my phone for tracking purchases on the run. It’s simple to use and i can link between devices.

TRACKMYSPEND is an amazing application. It helps you in analysing and improving your money spending.

Unfortunately, they are no longer updating it :(

Hi, these apps are fine if you want a snapshot of where you are at but true financial control is knowing where you are going via a cash flow projection where you can see future income, future bills allowing to establish how much you can spend before getting into trouble. Any ideas on a free app that facilitates this?

Good question! I still prefer an old-fashioned spreadsheet for that kind of thing. I’ll keep an eye out for apps that do future predictions. But you can’t beat a spreadsheet for that kind of thing. This is how I used to do it here: https://www.frugalandthriving.com.au/excel-tutorials-for-personal-budgeting/

Money manger ex it has cash flow report for up to a year.

Not a splashy as some of the other ones. Does the job but bit of a learning curve. Free and Android app as well.

Thank you for sharing the reviews of these apps. I’d like to point out though, your webpage is not easy to read because of those constant pop out ads, the article was moving all the time when I was scrolling down….

Glad you found the article useful.

Thanks for the recommendations. Sadly Money Brilliant has been bought by Westpac and is closing down in December. Very disappointing.

Good to know. Time for an update. Thanks.

Just letting you know that moneybrilliant was acquired by a bank and no longer works. It was great app, and back to the same point of how to protect our data when we need to use apps.

Thanks for that.

Just a quick note that pocketbook was discontinued over a year ago.

Just a quick thought on linking to your bank account:

Never share your login. Ever.

Your bank (I’m with Bank of Queensland) should allow you to set up a guest login with restricted rights – i.e list transactions only. This way you can be sure that, even if the company was taken over or hacked, your bank account would still be safe. Though I’d still ditch that logon pronto for privacy reasons.

Having said that, unless you are using cash and stay off the web, there are a lot of corporations who know more about your spending habits than you do. And are advertising to you all the time.

Thank you. Very important point. Thanks for sharing about the guest login. And you’re right – I’m pretty sure Google knows me better than I do 😬